Global Due Diligence Services

Maximize your investment and reduce risk with a comprehensive background check on businesses or individuals before signing any contract. Whether preparing for a merger, acquisition, partnership, or investment, our thorough analysis uncovers critical insights, empowering you to make confident, well-informed decisions.

Our Due Diligence services

Vendor Due Diligence

Our service relies on open-source, desktop searches and field research to identify potential red flags in vendor relationships. This process can be implemented as part of periodic monitoring to assess whether current and future vendors comply with applicable international and national laws and regulations. Efficient large-scale vendor screening is seamlessly managed through our proprietary platform Know Your Vendor™. Our experts conduct comprehensive checks, including:

- Beneficial ownership search through corporate records

- Open-source inquiries, including digital and physical media inquiries

- Global sanctions checks, a series of database searches to verify if an individual appears on international sanctions lists for criminal activities

- PEP checks

- On-site field visits

Reputational Due Diligence

This is the most popular category within our due diligence services, as it combines open-source and desktop searches with thorough inquiries to identify potential red flags, assess the reputation, and evaluate the track record of both the company and its principals. The activities involve performing both office tasks and field assignments:

- Beneficial ownership search through corporate records

- Open-source inquiries, including digital and physical media inquiries

- Global sanctions checks and PEP checks

- On-site field visits

- Reputation checks with clients and suppliers

- Source inquiries

- An executive summary presenting contextual insights and a risk analysis

Enhanced Due Diligence

This service integrates reputational due diligence with interviews conducted with the company principals. When our clients agree to facilitate these interviews, the methodology becomes highly effective. Our interviewing techniques and compliance questionnaires enable us to address a wide range of issues, identify potential risks, and delve deeper into various aspects of traditional due diligence processes.

A more comprehensive assessment that includes:

- Beneficial ownership search through corporate records

- Open-source inquiries, including digital and physical media inquiries

- Global sanctions checks and PEP checks

- On-site field visits

- Reputation checks with clients and suppliers

- Source inquiries

- Interviews with the principals of the targeted company

- Comprehensive review of findings and supplementary research.

- An executive summary presenting contextual insights and a risk analysis

Our scope covers

Human Rights Due Diligence

Providing essential visibility into how human rights are upheld across a business’s entire value chain, from operations and supply chains to service providers.

Commercial Due Diligence

Presenting a thorough analysis of a target business’s market positioning, growth potential, and competitive landscape.

Market Due Diligence

Gather pertinent information from industry experts, competitors, customers, and other market participants to inform acquisition or investment decisions in a targeted market.

Integrity Due Diligence

Collect and assess information on a company’s potential risks concerning legal issues, corruption, and regulatory compliance to ensure informed decision-making.

Customer Due Diligence

It involves verifying customer identities and assessing associated risks before forming a business relationship. Know Your Customer (KYC) is vital for complying with anti-money laundering (AML) regulations and helps organizations mitigate risks of fraud, financial crime, and reputational damage.

Employee Due Diligence

Assessing the background of employees to ensure a trustworthy and secure workplace. Know Your Employee (KYE) is essential for mitigating risks related to fraud, misconduct, and compliance violations.

Competitive Intelligence

Defining, collecting and, analyzing information about products, customers, competitors, and other relevant aspects of the business environment. This intelligence supports executives and managers in making informed strategic decisions for the organization.

Market Intelligence

Providing essential insights into the company’s market to navigate its business effectively. This information encompasses market conditions, competitor analysis, emerging opportunities, and overall market development.

How does Integrity International carry out the due diligence process?

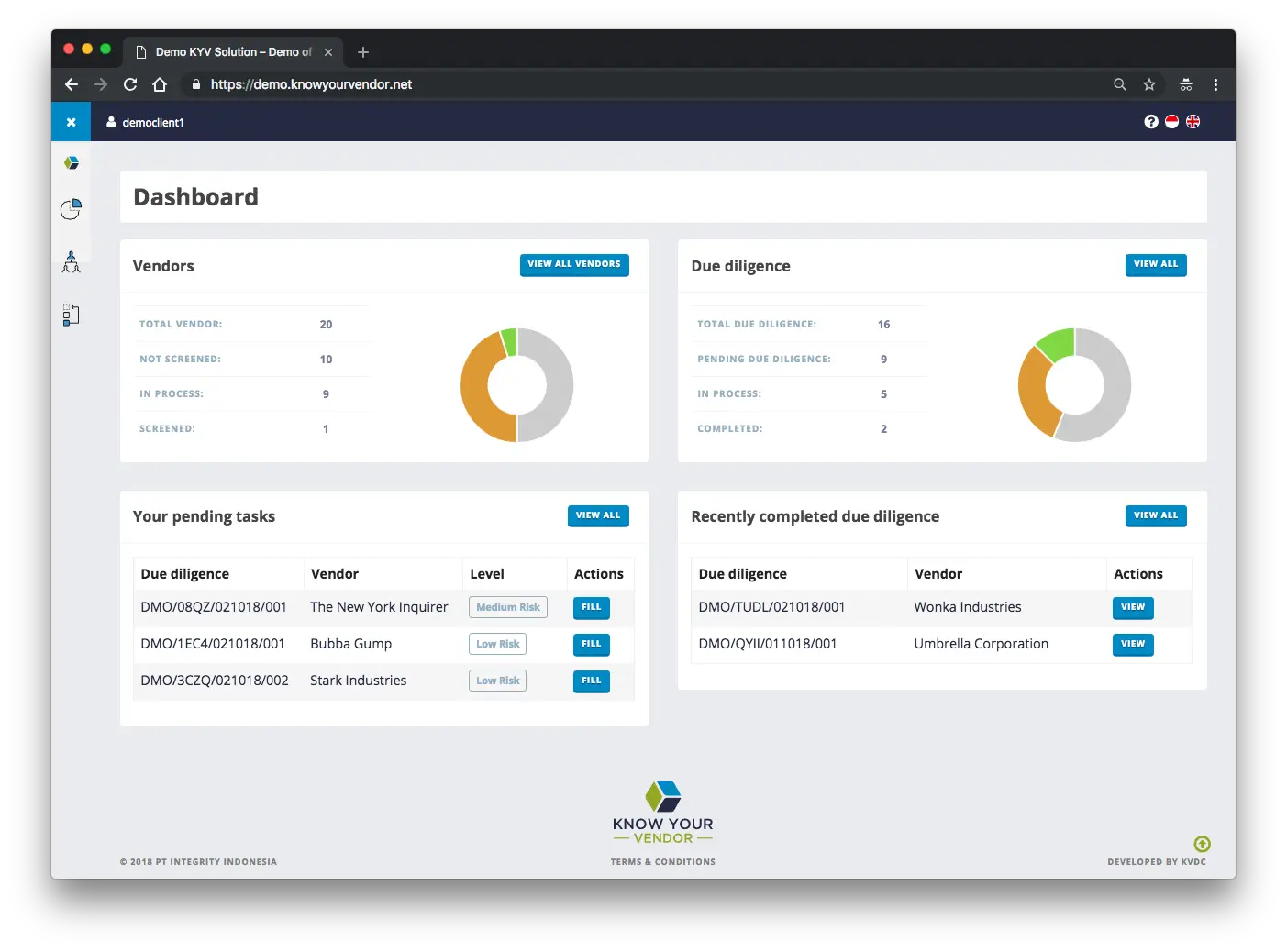

Seamless Due Diligence With Know Your Vendor™

Know Your Vendor™ is our innovative solution that helps clients mitigate supply chain risks through comprehensive third-party due diligence.

By leveraging advanced technology, you can easily import vendor data, assign tailored questionnaires, and monitor progress in real time.

Access detailed reports and scoring with just a click, ensuring you have the insights needed to make informed vendor decisions.

Manual creation of vendors and sub-vendors

Manual creation of vendors and sub-vendors

Import database of vendors and sub-vendors

Import database of vendors and sub-vendors

Classification scheme and tagging system

Classification scheme and tagging system

Due diligence completion status

Due diligence completion status

Communication channel

Communication channel

User-friendly dashboard

User-friendly dashboard

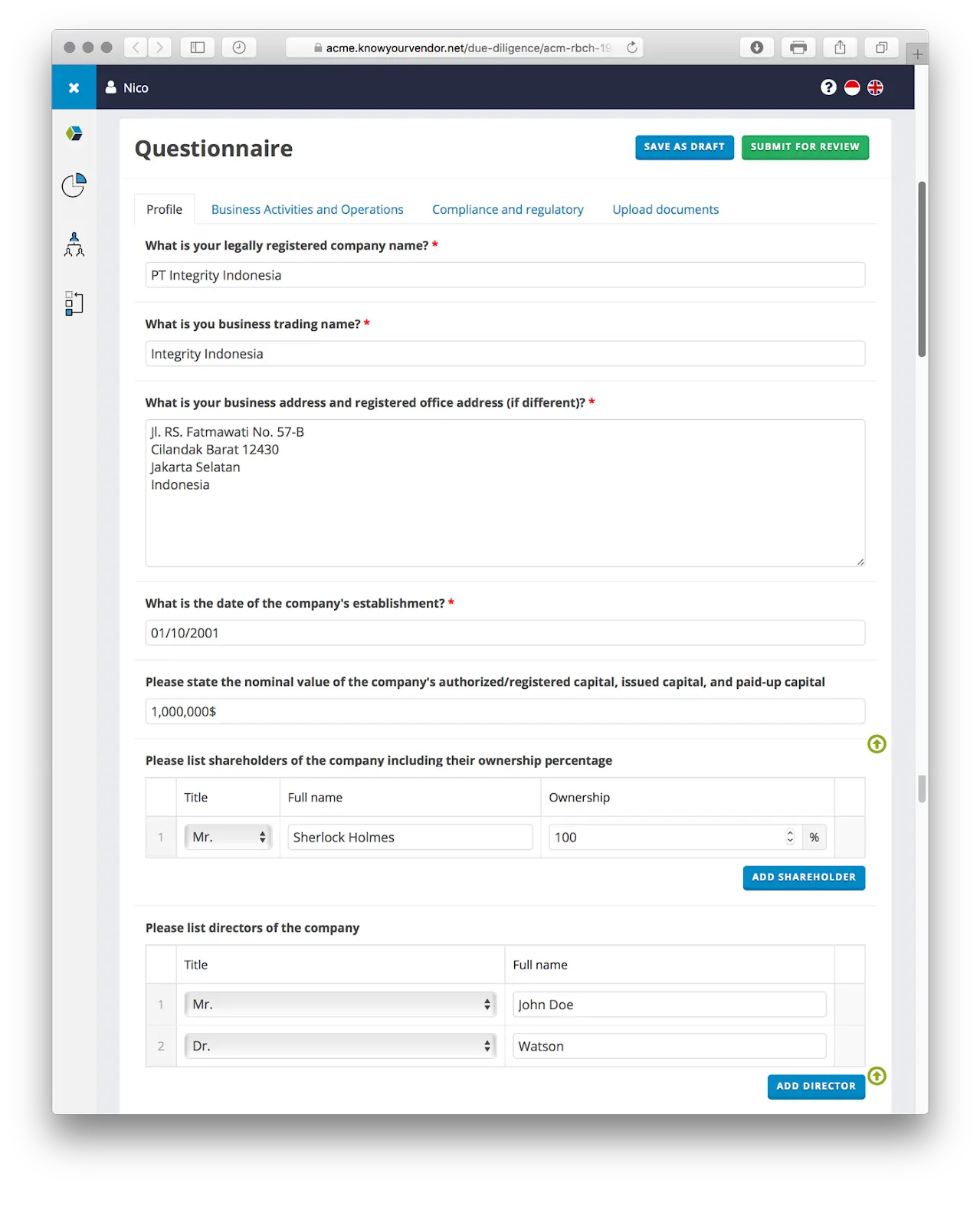

Clients can choose the level of due diligence required for each vendor, with onboarding handled by their compliance team or initiated via an invitation for the vendor to complete a questionnaire.

Customized compliance questionnaire

Customized compliance questionnaire

Vendor onboarding feature with compliance questionnaire

Vendor onboarding feature with compliance questionnaire

Document upload

Document upload

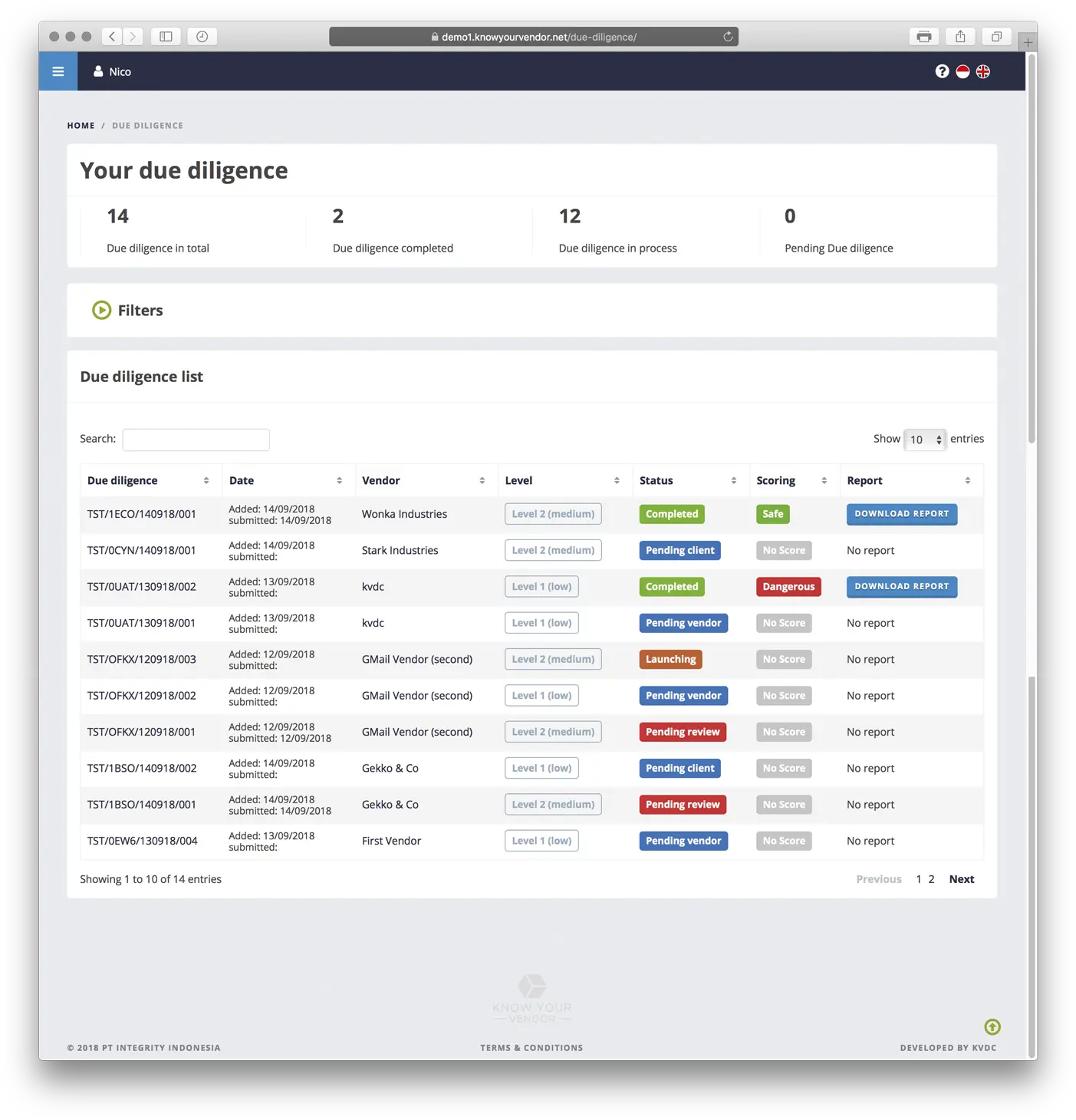

Clients can order due diligence based on predefined packages tailored to risk levels. Features include:

Customized due diligence packages

Customized due diligence packages

Follow-up discussion board for the screening process

Follow-up discussion board for the screening process

Overview of screening status

Overview of screening status

Scoring system

Scoring system

Access to due diligence reports

Access to due diligence reports

Make informed business decisions with us. Send your inquiries

Frequently asked questions

Yes, due diligence can be customized to address specific needs, focusing on particular risk areas or industry concerns to meet the client’s unique objectives.

Yes, your case information and identity will be protected. We prioritize confidentiality and adhere to strict data protection protocols to ensure that all information is securely stored and handled. Only authorized personnel will have access to your data, and we employ encryption and other security measures to safeguard your privacy throughout the due diligence process. Additionally, we are willing to sign a Non-Disclosure Agreement (NDA) to further assure you that your information will be treated with the utmost confidentiality.

The duration of due diligence can vary based on the complexity of the case and the depth of the examination required. Typically, due diligence can take anywhere from a few weeks to less than a month. Factors such as the volume of information to review, the number of stakeholders involved, and the necessity for comprehensive background checks can influence the timeline.

The cost of due diligence varies based on the scope and complexity of the project. Factors such as the level of detail required, the type of due diligence (reputational or enhanced), and the size of the company being assessed all influence the final price. We are able to customize our services to fit your needs.

You can fill out the form above, or alternatively, reach us by email at [email protected]. Our team is here to assist you!

We prioritize confidentiality and data security. Our report is encrypted, handled by authorized personnel only, and shared through secure channels.

Yes, Integrity International can provide you with an official proposal tailored to your case. Please contact us with the details of your requirements, and our team will prepare a comprehensive proposal for you.

Absolutely! We provide a detailed written report upon completion of the assignment to ensure you have a comprehensive understanding of the results